BTC Price Prediction: Analyzing Short-Term Targets and Long-Term Projections Through 2040

#BTC

- Technical Outlook: BTC shows consolidation patterns near all-time highs with bullish MACD divergence

- Institutional Demand: Harvard's ETF disclosure and $91.5M inflows signal growing institutional participation

- Long-Term Value Proposition: Energy value metrics suggest BTC remains undervalued despite record hashrate

BTC Price Prediction

BTC Technical Analysis: Short-Term Consolidation Likely Before Next Move

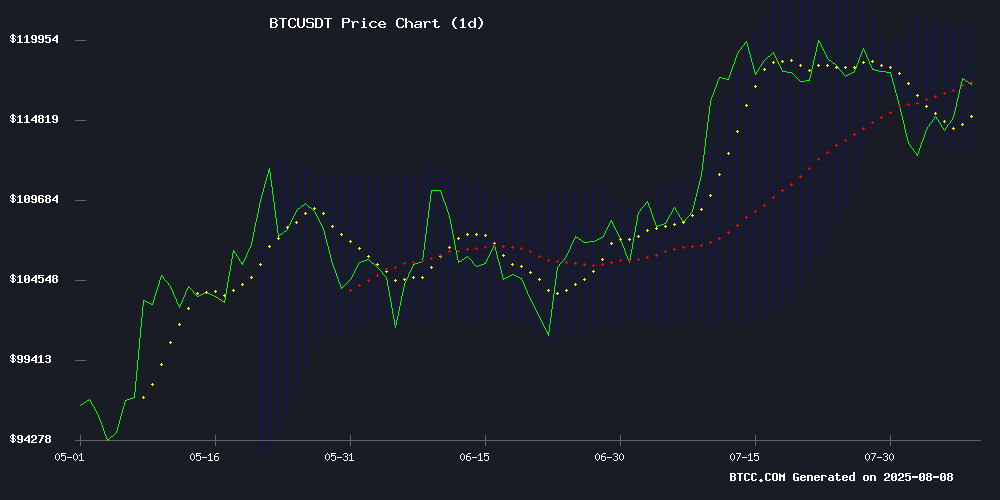

According to BTCC financial analyst Michael, Bitcoin is currently trading at $116,657, slightly below its 20-day moving average of $116,731. The MACD indicator shows bullish momentum with the histogram at 973.0555. Bollinger Bands suggest a range-bound market between $120,766 (upper) and $112,695 (lower). 'The price action indicates consolidation near all-time highs,' Michael notes. 'A decisive break above the 20-day MA could signal continuation toward $120K, while failure to hold $112K may trigger profit-taking.'

Market Sentiment: Cautious Optimism Amid Institutional Adoption

'The combination of institutional inflows and reduced volatility creates a bullish setup,' says BTCC's Michael. Key developments include Harvard's $116.7M bitcoin ETF allocation and renewed ETF inflows totaling $91.5M. However, Michael cautions: 'While the Trump administration's pro-crypto stance and record hashrate are positive, the market remains vulnerable to macroeconomic shifts. The 10,000 BTC accumulation by smaller wallets suggests retail confidence at these levels.'

Factors Influencing BTC’s Price

Bitcoin Volatility Hits Multi-Year Lows Amid Unprecedented Price Stability

Bitcoin's price behavior has entered a phase of remarkable stability, with volatility metrics plunging to levels unseen since October 2023. The BVIV index records 30-day implied volatility at just 36.5% annualized—a striking development for an asset that traded below $30,000 during its last period of such calm. Current prices hover above $110,000, defying expectations that such appreciation would bring heightened turbulence.

The anomaly grows more intriguing when considering Bitcoin's 57% surge from $70,000 since November 2024. Traditional market wisdom suggests such rallies coincide with expanding volatility, yet options traders appear unconvinced of impending large moves. This divergence hints at evolving market dynamics, possibly reflecting growing institutional participation that dampens wild price swings.

Bitcoin Profit-Taking Activity Cools as Market Stabilizes Near $115K

Bitcoin's price resilience at $115,000 signals renewed market confidence, with short-term holders reducing profit-taking activity. Glassnode data reveals only 45% of STHs are selling, well below neutral levels—a bullish divergence from typical volatility-driven selloffs.

The on-chain analytics firm notes 70% of short-term holder supply remains profitable, with nearly balanced profit/loss coin movements. This equilibrium suggests a maturation phase rather than speculative frenzy, as investors appear to anticipate higher valuations.

Bitcoin Price Eyes ATH as Shrimps Bag 10,000 BTC in Days

Bitcoin's price continues its upward trajectory, with small investors—dubbed 'Shrimps'—accumulating nearly 10,000 BTC in a single week. This surge in demand comes amid stable market conditions and profit-taking by long-term holders.

According to Glassnode, wallets holding less than 100 BTC added over 17,000 BTC this month, outpacing the new supply of 13,850 BTC. The trend signals a net reduction in available Bitcoin, driven largely by retail investors.

Trading activity has cooled since mid-July, with spot volume dropping from $10.22 billion to $6.61 billion and futures volume declining from $60.17 billion to $41.05 billion. Despite the dip, volumes remain above July's lows.

Crypto analyst Ali Martinez notes long-term holders sold roughly $44.5 million in Bitcoin over two days, suggesting a rotation of assets rather than a loss of confidence.

Harvard Discloses $116.7M Bitcoin Allocation via BlackRock's IBIT ETF

Harvard Management Co. has taken a significant step into digital assets with a $116.7 million position in BlackRock's iShares Bitcoin Trust. The 1.9 million shares represent approximately 8% of its $1.4 billion SEC-reported portfolio, surpassing its gold holdings.

The Ivy League endowment now holds more Bitcoin than gold, with SPDR Gold Trust shares valued at $102 million. This move signals institutional maturation of crypto investments, placing Bitcoin alongside Harvard's mega-cap equity positions in Microsoft, Amazon, and Meta.

Harvard's crypto journey dates to 2018 with early venture fund allocations. The Blockstack token sale in 2019 further revealed its exploratory approach. Today's disclosure marks the clearest institutional endorsement yet from traditional finance's most prestigious circles.

Bitcoin ETFs Rebound with $91.5M Inflows After Prolonged Outflows

U.S. spot Bitcoin ETFs snapped a four-day outflow streak with $91.5 million in net inflows on August 6, signaling a potential resurgence of institutional confidence. BlackRock's IBIT led the charge with $48.1 million, reinforcing its dominance since the January 2024 ETF approvals.

Fidelity's FBTC contributed $20.3 million, while VanEck and Franklin Templeton added smaller but notable inflows. Grayscale's GBTC outflows slowed to just $3.5 million—a significant reduction from previous weeks. The reversal coincides with stabilizing macro markets and suggests renewed appetite for crypto exposure.

Bitcoin Stabilizes as Profit-Taking Eases, Yet Underlying Risks Persist

Bitcoin's price action shows tentative stabilization after months of volatility, with on-chain data indicating a significant reduction in profit-taking behavior. Glassnode reports a 50% decline in daily realized profits since December 2024, falling from $2 billion to $1 billion per day—a potential inflection point for market equilibrium.

The proportion of short-term holders selling has dipped below the neutral 50% threshold to 45%, creating what analysts describe as a 'relatively balanced position.' This decline in speculative selling pressure typically precedes periods of reduced volatility, though the $116,000 resistance level looms as a critical test following July's $123,000 all-time high.

Harvard Endowment Discloses $116M Bitcoin ETF Stake in SEC Filing

Harvard Management Company revealed a $116 million position in BlackRock's iShares Bitcoin Trust (IBIT), marking one of the largest known cryptocurrency allocations by a U.S. university endowment. The holding, disclosed in a June 30 SEC filing, reflects growing institutional adoption of regulated bitcoin products.

The spot ETF structure provides daily liquidity and regulatory oversight—critical features for endowments navigating compliance requirements. IBIT has become a preferred vehicle for institutional exposure since its January 2023 launch, with assets across U.S. bitcoin ETFs now measuring in the tens of billions.

This move places Harvard alongside pension funds and hedge funds incorporating digital assets into traditional portfolios. The university declined to elaborate beyond the regulatory filing, maintaining discretion characteristic of endowment investment strategies.

Trump Executive Order Sparks Crypto Rally as Retirement Plan Rules May Ease

President Trump's executive order has ignited optimism in cryptocurrency markets, directing the Labor Department to reconsider fiduciary rules that currently restrict alternative assets—including Bitcoin and other digital currencies—from 401(k) and retirement plans. The move signals potential institutional validation for crypto as an asset class.

Bitcoin surged nearly 3% on Thursday following early reports of the order, though gains partially retraced by Friday afternoon. The directive explicitly cites cryptocurrencies alongside real estate and private equity as underutilized investment options for retirement portfolios.

Market reaction preceded the official signing, demonstrating crypto traders' sensitivity to regulatory developments. The Labor Department now collaborates with the SEC to evaluate necessary regulatory adjustments, potentially removing legal barriers that have kept digital assets out of mainstream retirement products.

Bitcoin's Energy Value Suggests Historic Undervaluation Amid Record Hashrate

Bitcoin's market price may be significantly undervalued relative to its energy-based fundamentals, according to Capriole Investments' proprietary metric. The firm's 'Energy Value' model—developed by Charles Edwards—pegs BTC's fair value at $167,800, representing a 45% premium to current levels. This valuation gap emerges as network hashrate hits an all-time high of 1.031 ZH/s, signaling robust miner participation despite recent profitability challenges.

The energy valuation model directly correlates Bitcoin's price with the electricity consumed by its proof-of-work consensus mechanism. Edwards notes the current disparity is unprecedented, reviving debates about whether market prices will eventually converge with this fundamental metric. However, analysts caution that any decline in hashrate could rapidly diminish the projected upside.

Mining economics have regained equilibrium after the 2022 downturn, with rising hash rates confirming renewed infrastructure investment. Glassnode data shows miners are deploying next-generation equipment to capitalize on improved efficiency. Yet the market appears slow to price in these network fundamentals—a dynamic that historically precedes major valuation resets.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market structure, BTCC's Michael provides these projections:

| Year | Conservative Target | Bull Case | Catalysts |

|---|---|---|---|

| 2025 | $125,000 | $150,000 | ETF adoption cycle, halving aftermath |

| 2030 | $300,000 | $500,000 | Institutional infrastructure maturity |

| 2035 | $750,000 | $1.2M | Network effect dominance |

| 2040 | $1.5M | $3M+ | Global reserve asset status |

Key variables include regulatory clarity, ETF flows, and Bitcoin's share of the global store-of-value market.